Investec Reserves £30 Million as FCA Investigates Motor Finance Commissions

Investec, a London-listed South African banking group with approximately 1,600 bankers in London, reserves £30 million to cover potential compensation and other related costs and fees as the Financial Conduct Authority probes the historical motor finance commission arrangements and sales practices of financial firms in the UK.

However, despite the allocation for the potential ruling of the FCA, the firm strongly believes that they only received few complaints related to the practice of discretionary commission arrangements (DCAs).

“Nevertheless, the group recognises that costs and awards could arise in the event that the FCA concludes there has been industry wide misconduct and customer loss that requires remediation,” the firm said. “Those costs and awards could arise as the result of a redress scheme, or from adverse FOS/litigation decisions.”

Amid this potential losses of the firm, Investec remains positive as they have reported a five per cent increase in their operating income. “Revenue momentum is expected to continue, underpinned by book growth, stronger client activity levels and success in our client acquisition strategies; partly offset by expected cuts in interest rates”, said Investec.

Investec and the Motor Finance Sector

Investec began investing in the UK motor finance market in 2015. As of 2021, it has recorded a total of £555 million in booked business, equivalent to 1% of the market share.

In 2024, Investec declared a record dividend of 19 pence per share, equivalent to 34.5 pence per share. The firm attributed this to the high interest rates that boosted its net income.

FCA Scrutinises the Discretionary Commission Agreement (DCA)

The Financial Conduct Authority is examining the practice of financial firms in the Discretionary Commission Agreement (DCA). The DCA allows car dealerships to earn more by raising the interest rates for the buyer. This was banned in 2021 because it only incentivized car dealers. This gave car dealers the option to select higher rates, benefiting both the dealers and the banks.

The FCA is reviewing deals made between April 2020, when the Financial Ombudsman Service started to oversee the DCA, and January 2021, when it was banned.

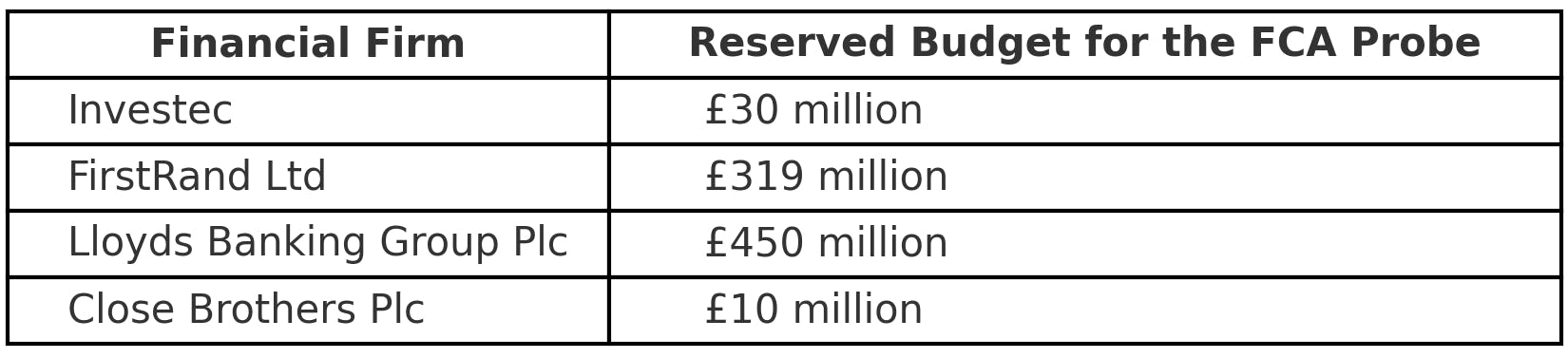

Other Financial Firms Set Aside Budget for the FCA Probe

Aside from the £30 million of Investec, other financial firms have also set aside a budget for the potential costs of the FCA’s probe.

FirstRand Ltd, South Africa’s largest bank by market value, has allocated £319m for the related costs for its MotorNovo units in February.

In March, Lloyds Banking Group Plc reserved £450 million in anticipation of potential costs, such as legal fees, compensation for affected consumers, or fines, resulting from FCA’s investigation.

The Close Brothers hopes to set aside £400 million by bolstering its finances in response to the probe.

Financial Conduct Authority Warns Financial Firms

The Financial Conduct Authority issued a letter to motor finance firms stating that they “must maintain adequate financial resources at all times” while the investigation is ongoing.

The FCA also observed that financial firms are taking different approaches to account for the potential impact of their previous use of the Discretionary Commission Agreement (DCA) on their financial resources.

This was after months of speculation about the scope of the investigation in motor finance DCA and its financial impact on the financial firms that will be required to provide compensation.

Financial firms' plans should include all the potential additional operational costs from increased complaints and the costs of resolving those complaints.

Financial firms need to be more than ready for the outcomes of this probe, for the deals being reviewed are from 2017 to 2021.

Impact of FCA Probing on Financial Firms

Despite the FCA's current investigation, Investec continues to perform well in the market. In 2024, Investec declared a record dividend of 19 pence per share, up from 34.5 pence per share, “Thanks to higher global interest rates,” according to them. This allowed the firm to reserve £30m for potential fees and costs after the investigation.

On the other hand, Lloyds made a £450m provision for the potential impact of the investigation. This amount will be allocated to the estimated costs and potential redress of the investigation. The firm is also open to the idea that this amount might increase as the investigation progresses. They even believe that it could rise to £2bn.

While Investec and Lloyds are confident about addressing the investigation's financial repercussions, Close Brothers seems to struggle financially. Their shares have collapsed by over two-thirds since the FCA published the reviews.

Based on the analysis, Close Brothers is currently expecting up to £200m in compensation payouts. The firm has already scrapped its dividend for 2024 to help fund the redress and might also freeze 2025’s distribution.

Further, other firms not exposed to the DCA probe have warned about higher costs. S&U, the specialist auto and property lender, said that while it never engaged in DCAs, the firm reached a sum of £8.2m in increase in financial provision. This provision aligns with the IFRS 9 accounting rules that require lenders to account for potential losses based on expected cash flows.

According to RBC, an investment bank, the estimated liability of the motor finance industry is £8 billion, based on all the funds these financial firms reserve. This amount was later raised to £16 billion.

Investec Believes that DCA was Compliant with the Laws and Regulations

“We received a small number of complaints.”

This is according to Investec as regards the probe about its use of DCA. They believe their use of DCA was compliant with the laws and regulations at the time.

While confident about how they applied DCA in their previous deals, they still recognize the potential costs and fees after the FCA probe.

“Nevertheless, the group recognizes that the costs and awards could arise in the event that the FCA concludes there has been industry widespread misconduct and customer loss that requires remediation,” according to them.

They added, “These costs and awards could arise as the result of a redress scheme, or from adverse FOS and/or litigation decisions.”

Investec Takes Proactive Steps

“We feel that it is prudent to take a provision.”

This is according to Ruth Leas, Head of Investec's main banking subsidiary. The firm announced the £30m that it reserved for potential costs and fees after the FCA probe.

“We acknowledge significant uncertainty around this estimation and will need to wait for the FCA’s review outcome later this year,” she added.

Investec Moving Forward

While the FCA probe is alarming to financial firms, Investec remains optimistic about its future success in the financial market. Where is Investec headed?

1. Streamlining its business

Investec is restructuring its operations to focus on its core activities, making them more efficient and profitable.

2. Spinning off Asset Management Holdings into Ninety One Ltd

Investec separates its asset management business, which handles investments on behalf of clients, by making it a standalone company - Ninety One Ltd. Through this, Investec could allow the new company to focus solely on asset management. At the same time, Investec concentrates on other areas, such as banking.

3. Merging the UK Wealth Unit with Rathbones Group

Investec’s wealth management division has merged with Rathbones Group, a UK-based management firm. This merger allows Investec to expand its wealth management services and strengthen its position in the UK market.

4. New medium-term targets

Investec set new financial goals for the next few years. Two specific targets are-

- Return on Equity (ROE) to 17%

- Increase dividend payout to 50% of adjusted Earnings Per Share (EPS) from 35% previously

This proactive move of Investec reflects their commitment to adhering to whatever the ruling of the Financial Conduct Authority as regard the application of the discretionary commission arrangements. While the probe poses potential income loss for Investec, the firm remains confident about their growth and stability in the financial market.