The Timeline of PCP Complaints & Claims: Key Developments in Consumer Rights

News 1 October 2025 | Andrew Franks |

Updated: 01 October 2025

Originally Published: 29 November 2024

Car finance transformed how people in the UK buy cars. Instead of saving for years, many drivers used Personal Contract Purchase (PCP) or Hire Purchase (HP) to spread the cost. For plenty of households, this was a lifeline. For others, it became a source of stress. More and more motorists are discovering their agreement may have been mis-sold car finance, with higher-than-necessary interest, hidden charges, or commissions that were never explained. That realisation has driven a wave of car finance claims and a spotlight on the wider car finance scandal.

At the centre sits one practice in particular: dealers earning commission that rose when your interest rate rose. Many customers were never told this. That lack of transparency, combined with confusing contracts and pressure selling, has created a long tail of grievances. If you are thinking about a car PCP claim or want to run a quick PCP claim check to see if you may be due car loan compensation, this guide walks you through what happened, when, and what to do now.

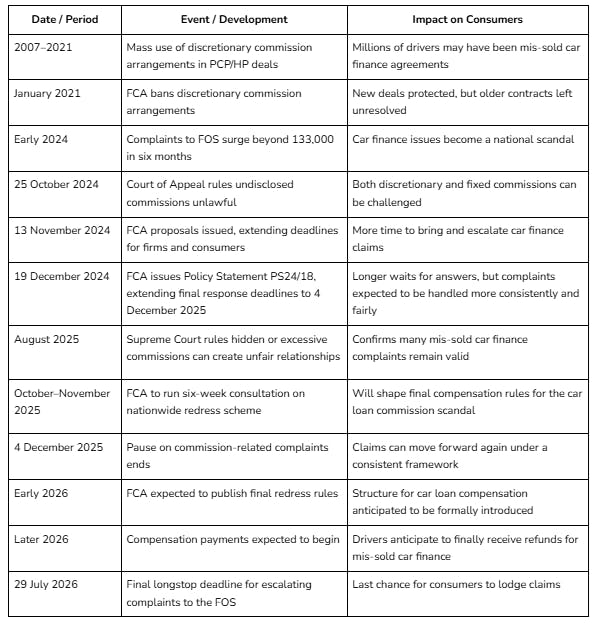

Timeline at a glance

2007–2021: how mis-selling took root

Between April 2007 and January 2021, PCP and HP became the default way to fund a car. Low monthly payments and multiple end-of-term options made PCP look simple. Behind the scenes, many contracts relied on discretionary commission arrangements. In plain English, a dealer could increase your interest rate and earn a bigger commission. Most customers were not told this, which is why so many agreements are now challenged as PCP mis-sold.

Other common problems during this period:

- Hidden costs that appeared later, such as admin fees or early-settlement penalties.

- Balloon payments that were not clearly explained at the start.

- Weak affordability checks, so some people were put into deals they could not realistically manage.

- Dense jargon that made it hard to understand the total cost or your choices at the end.

If any of that sounds familiar, you are far from alone. These are exactly the issues that sit behind today’s car finance claims.

The FCA ban in 2021

The regulator, the Financial Conduct Authority (FCA), saw the problem. From January 2021, it banned discretionary commission in new agreements [1]. That stopped the practice for future deals, but it did not fix the past. Older contracts are still the focus of the car loan scandal, because they were written while those commission models were common.

2024: complaints surge and court action starts to bite

By 2024, complaint numbers spiked. The Financial Ombudsman Service (FOS) received more than 133,000 complaints in the first half of the year, up by about 40 percent in the same period in 2023 [2]. Over 50,000 involved motor finance. People pointed to undisclosed commissions, confusing terms, high balloon payments, and interest rates that felt out of step with the market. Many asked for car loan compensation and for lenders to put things right.

Courts began drawing clear lines. On 25 October 2024, the Court of Appeal ruled that dealers cannot take commission without clearly telling customers [3]. Importantly, that reasoning covered not only discretionary commission but also fixed commissions that were not disclosed. That widened the door for challenges and gave renewed momentum to the car loan commission scandal.

Late 2024: the FCA reshapes timeframes

With complaints piling up, the FCA responded. On 13 November 2024 it proposed longer timelines so firms could investigate thoroughly and customers had a fair chance to escalate:

- Some firms could respond as late as 31 May 2025 or 4 December 2025.

- Consumers would have 15 months to escalate to the FOS, instead of the usual six.

- A longstop of 29 July 2026 was set for most commission-related complaints to be escalated [4].

In December 2024, the FCA issued policy statement PS24/18, extending the deadline for firms to respond to motor finance complaints about commission arrangements until 4 December 2025 [5]. This meant consumers faced longer waits, but the regulator argued it would prevent inconsistent outcomes and give firms time to investigate cases properly.

August 2025: the Supreme Court clarifies the law

The Supreme Court gave important guidance in August 2025 [6]. It confirmed that commission itself is not automatically unlawful. However, if the commission was hidden or so large that it tilted the relationship against the consumer, then the overall deal can be judged an unfair relationship. That keeps many mis-sold car finance cases very much alive. It also confirms that both discretionary and fixed commissions can be scrutinised if they were not transparent.

If you have hesitated about a car PCP claim because you were unsure where the law stood, this clarification matters. It means a lot of older agreements still have a path to redress, particularly where disclosure was poor or the interest rate looks inflated for no clear reason.

October to November 2025: consultation on a redress scheme

The FCA will run a six-week consultation in October 2025 to design a nationwide approach to car finance compensation [7]. Expect answers to the questions many people ask in a PCP claim check:

- How will compensation be calculated in a consistent way across lenders.

- Which agreements are in scope.

- How older cases will be treated.

- What evidence will typically be required.

Final rules are expected in early 2026, followed by payments later that year. While the complaint pause remains in place until 4 December 2025, submitting your complaint now still helps. Early action secures your place in the queue once the system moves again.

December 2025 and beyond: the pause ends, payments follow

On 4 December 2025, the pause on commission-related complaints will end. Cases can start progressing under a consistent framework. The FCA intends to publish final rules in early 2026 [8], with the first payments expected later that year. If you have already lodged your complaint, you will be better placed as things restart.

Do not forget the 29 July 2026 longstop for most commission-related complaints to be escalated to the FOS. If you leave it too late, you may miss out on car loan compensation even if your agreement was mis-sold.

What this means in real life

It is easy to get lost in dates and rulings, but this is about everyday families and budgets. Common stories include:

- Someone who thought they got a fair rate, then learned the dealer could increase it to earn more, without telling them.

- A driver who was never prepared for the size of the balloon payment and had to return a car they loved.

- A buyer who felt rushed through paperwork and only later realised the monthly payments were not affordable once everything else was paid.

These are exactly the scenarios the car finance scandal is trying to address. The goal is simple: better transparency, fairer pricing, and redress where things went wrong.

Am I eligible to claim

You may have grounds for a complaint if any of the following apply:

- You were not told about commissions paid to the dealer or broker.

- Your interest rate looks higher than it should have been given your credit profile and the market at the time.

- Key terms were unclear, especially around balloon payments or mileage.

- You were charged fees that were not explained upfront.

- You felt pressured to sign or were not shown realistic alternatives.

If that sounds familiar, start with a PCP claim check. Many firms offer a free initial review, and you can complain directly to your lender if you prefer. If your case is in scope, it becomes part of the PCP claims timeline that leads to a decision and, potentially, car finance compensation.

How much might I receive

The regulator has indicated an average redress of about £950 per agreement for commission-related cases [9]. That is an average, not a cap. Real outcomes vary with loan size, length of agreement, and how much the interest rate was inflated. Compensation can include:

- Refunds of overpaid interest.

- Return of hidden or undisclosed commissions.

- Refunds of unfair fees.

In some cases, an extra amount may be provided where the situation caused significant distress or financial difficulty.

If you want a sense check before you complain, a PCP claim check or calculator can help you understand potential ranges, although the exact outcome depends on the evidence and the final FCA rules.

How to bring a car PCP claim

You can do this yourself. Here is the simple route.

- Collect documents. Agreement, statements, emails with the dealer or lender. If you do not have them, ask your lender for copies.

- Write your complaint. Explain clearly what you were told, what you were not told, and why you think the deal was unfair or mis-sold.

- Give the lender time. They normally have up to eight weeks to respond, though extended timelines still apply in many commission-related cases.

- Escalate to the FOS if the response is missing or you disagree with it.

- Consider the support of a finance claims expert. A regulated claims management company or a solicitor can manage the admin processes and chase the case. Many work on a no-win, no-fee basis, but always check the fee and what is included.

If your question is “Can I claim if my agreement ended years ago”, the answer is usually yes, provided your claim is within the overall deadlines. The car loan scandal spans many years of agreements.

The role of finance claims experts

Plenty of people make effective complaints on their own. Others prefer help because it saves time and removes stress. Claims specialists can:

- Retrieve missing agreements and statements.

- Spot issues you might miss, such as multiple layers of commission or unfair fees.

- Push back on low offers.

- Keep deadlines moving so your case does not stall.

If you use a claims firm, check if they are FCA-authorised and clear about fees. If you use a solicitor, check SRA regulation and costs [10]. Both routes can work. The important thing is to pick one you trust.

Frequently asked questions

To help you cover the basics, here are the kinds of consumer questions drivers type into search boxes, with quick answers:

What is a PCP claim and how do I start one?

It is a complaint that your PCP was mis-sold or unfair. Start by asking your lender for your agreement, then send a written complaint. You can seek help later if you need it.

How do I run a PCP claim check without a lawyer?

You can check your own agreement by looking for hidden commission, high interest or balloon payments that were not explained. Many regulated firms also provide a free PCP claim eligibility checker online, which can quickly show if you may have grounds for a claim.

Do car finance claims apply to HP or only PCP?

Both HP and PCP are in scope for the car loan commission scandal, particularly where commission was not disclosed or terms were confusing.

What happens if the lender rejects my claim?

Escalate to the FOS. The Ombudsman can order compensation if it decides your agreement created an unfair relationship or was mis-sold.

Can I still get car finance compensation if I sold the car?

Yes. The key question is whether the agreement was unfair or mis-sold, not whether you still have the vehicle.

Is this only about commissions?

Commissions are a big part of the car loan commission scandal, but not the whole story. Poor disclosure, confusing terms and weak affordability checks also matter.

What documents should I keep?

Your finance agreement, payment history, any emails or letters with the dealer or lender, and any adverts or sales materials that influenced your decision.

How long do car finance claims take?

The standard rule is eight weeks for a lender response. For commission cases, extended timelines apply and the FCA has paused most processing until 4 December 2025. After the pause ends, cases should move faster under clear rules.

What if I cannot find my agreement?

Ask your lender. If you choose to use a representative, they can often obtain copies for you.

Is there a final cut-off date?

Most commission-related complaints must be escalated to the FOS by 29 July 2026. Do not wait for the last minute.

Will every claim be paid?

No. Outcomes depend on facts and evidence. The forthcoming rules should make decisions more consistent.

Can I complain now or should I wait?

Complain now. Getting into the system early helps. Your complaint will be considered under the framework that applies once the pause ends.

Is this the same as the PPI situation?

It is different in the details, but similar in principle. A widespread practice lacked transparency, and consumers are seeking redress.

Does a high balloon payment prove mis-selling?

Not by itself. The question is whether the balloon was explained clearly, the overall costs were fair, and whether commission disclosure and interest setting were handled properly.

What if I refinanced the balloon?

You can still complain about the original agreement if it was mis-sold and within the timelines.

Bottom line

The story of PCP complaints and car finance claims is a story about fairness. From 2007 to 2021, commission models flourished. In 2021 the regulator stopped the practice for new deals, but older contracts were left behind. By 2024 the number of complaints showed just how wide the problem ran. Court decisions in 2024 and the Supreme Court clarification in August 2025 confirmed that many agreements can still be challenged. The FCA’s consultation in October 2025 will set the rules for a national redress scheme, with payouts expected later in 2026.

If you think your agreement was mis-sold, run a PCP claim check, gather your paperwork, and submit your complaint. The PCP claims timeline is moving toward a clearer destination. With the car finance scandal now fully in the open, the route to car finance compensation and fair outcomes is finally taking shape for UK drivers.

References:

- From January 2021, it banned discretionary commission in new agreements - https://www.fca.org.uk/news/press-releases/fca-ban-motor-finance-discretionary-commission-models

- The Financial Ombudsman Service (FOS) received more than 133,000 complaints in the first half of the year, up by about 40 percent in the same period in 2023 - https://www.financial-ombudsman.org.uk/news/complaints-jump-40-year-year

- On 25 October 2024, the Court of Appeal ruled that dealers cannot take commission without clearly telling customers - https://www.linklaters.com/en/knowledge/publications/alerts-newsletters-and-guides/2024/october/29/court-of-appeal-decision-on-commission-disclosure-opens-door-to-more-consumer-claims

- A longstop of 29 July 2026 was set for most commission-related complaints to be escalated - https://www.financial-ombudsman.org.uk/consumers/complaints-can-help/credit-borrowing-money/car-finance/complaints-about-commission

- In December 2024, the FCA issued policy statement PS24/18, extending the deadline for firms to respond to motor finance complaints about commission arrangements until 4 December 2025 - https://www.fca.org.uk/publications/policy-statements/ps24-18-further-temporary-changes-handling-rules-motor-finance-complaints#:~:text=The%20rules%20described%20in%20this,until%20after%204%20December%202025.

- The Supreme Court gave important guidance in August 2025 - https://supremecourt.uk/uploads/uksc_2024_0157_0158_0159_judgment_2bb00f4f49.pdf

- The FCA will run a six-week consultation in October 2025 to design a nationwide approach to car finance compensation - https://www.fca.org.uk/news/press-releases/fca-consult-motor-finance-compensation-scheme

- Final rules are expected in early 2026 - https://consumervoice.uk/cars/fca-to-consult-on-car-finance-compensation-after-supreme-court-ruling/#:~:text=What%20happens%20next,First%20payouts%20expected%20in%202026

- The regulator has indicated an average redress of about £950 per agreement for commission-related cases - https://www.theguardian.com/business/2025/aug/04/who-will-get-car-loan-payout-how-much-regulator

- If you use a solicitor, check SRA regulation and costs - https://www.sra.org.uk/